Congratulations to the Drama Troupe and Mrs. Nielson on their State Competition. The trio of Adam Wright, Cash Parker, and Gavin Doughty placed 5th in their Original Humourous piece.! The troupe had fun and experienced valuable lessons this year.

Thank you for your generous donation to Change-4-Change Goffin Heritage Homes.! We appreciate you.

Looking for a fun holiday activity that the whole family can enjoy? Do you love Studio C and or Whose Line is it Anyway? Then TFHS Theater has the activity for you! Come see our Holiday Comedy Show on December 13 and 14 at 7 PM. We will be featuring holiday themed original comedy sketches written by the students and faculty of the theater department at TFHS, as well as performances from our in-house improvisation troupe, The Whoopsie Daisy Show! Admission is just $2 per person! Also, Santa will be in the house ready to visit with the kids after the show! Come let us have you "laughing all the way" to winter break and help support the theater arts program at TFHS while you're at it!

Join the Bruin High Players for a fun night of sketch comedy and a chance to get a picture with Santa. Admission is only $2/person.

Imagine trying to finish your homework in a car or a crowded space with no privacy. That’s the reality for some of our students experiencing homelessness. TFSD is committed to ensuring all students have the resources they need to succeed in school, and we need your help. Every donation to the Avenues for Hope campaign will help provide essentials like food, hygiene supplies, and more. Let’s give these students a fighting chance! Donate here: https://www.avenuesforhope.org/organizations/twin-falls-school-district #AvenuesForHope #SupportTFSD

Lane LeBaron Homes we can't thank you enough for your PLATINUM sponsorship! You made a difference in Bruins lives.

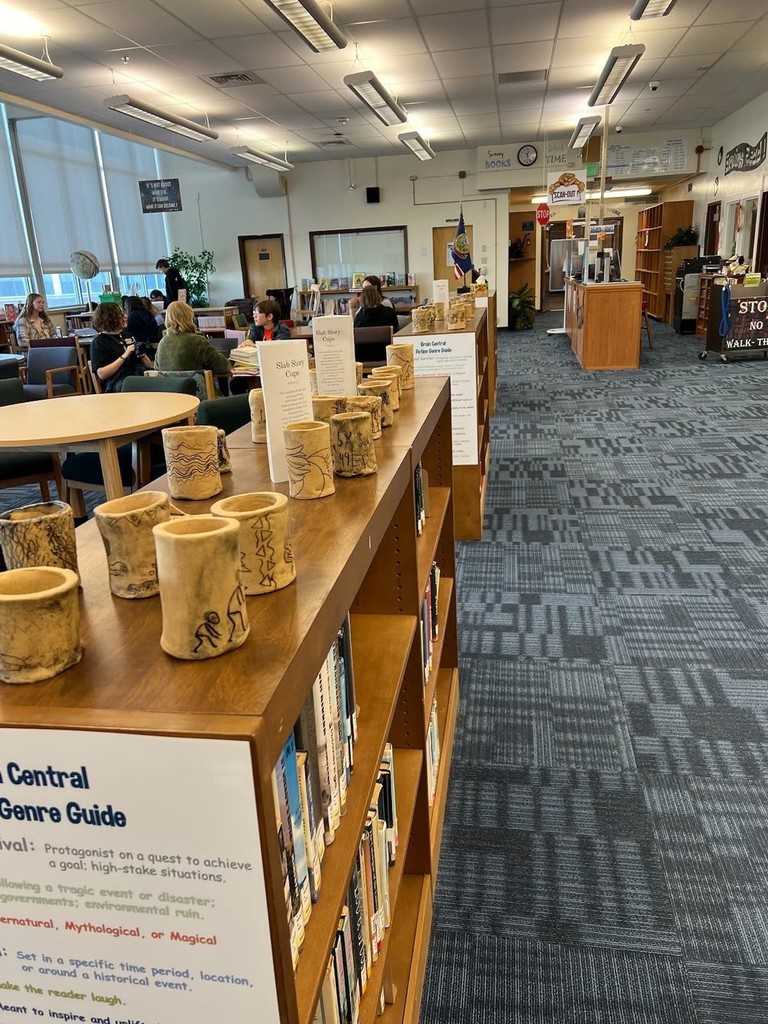

🎨Our talented TFHS Pottery students have been hard at work, and their beautiful slab cups were placed on display in Bruin Central for all to admire! 🖌️✨ These unique pieces showcase the creativity and skill of our students—and we couldn’t be more impressed with their work! A special shoutout to Mr. Jackson in his first year of teaching 🌟

#TFHSArt #PotteryCreativity #BruinPride #StudentArt #MrJacksonsClass #ArtInAction #BruinCentral

Wow, oh wow, our community business support has been amazing this year. Thank you Slice Pickleball for your donation toward Change-4-Change.

🎉 Huge Congratulations to the Speech and Debate Team at Twin Falls High School! 🎉

We are incredibly proud of our talented Speech and Debate students for their outstanding performances! Join us in celebrating these amazing achievements:

Speech:

🏆 Katelyn Miller – 1st in Sales

🏆 Emily Wright – 2nd in Impromptu, 2nd in Extemp

🏆 Eunsue Sheen – 1st in CA

🏆 Nayh Zavala & Ricky Roper – 1st in Duo

🏆 Maddux McClymonds – 3rd in HI

🏆 Sage Larson – 6th in ADS

🏆 Micala Wood – 3rd in ADS

Debate:

🏅 Micala Wood – Quarter-Finalist in LD

🏅 Caleb Willmore & Katelyn Miller – Semi-Finalists in PF, tied for 2nd Top Speakers

🏅 Team achieved 4th Place in Overall Sweepstakes!

#TwinFallsHigh #SpeechAndDebate #TFHS #ProudMoment #FutureLeaders #Teamwork #DebateChampions

Thank you Dog's Den for your generous support of Change-4-Change. and helping TFHS spread Christmas cheer!

We are so thankful for the outpouring of support from our local businesses to help provide Christmas for Bruin Families in need. Plant Therapy, we couldn't do it without you.

🐾❤️ A huge thank you to Idaho Central Credit Union for their generous donation to TFHS to help us acquire a therapy dog! 🐶 This initiative will provide comfort and support to our students, and we’re incredibly grateful.

#TFHS #TherapyDog #CommunityPartners #ThankYou

Huge shout out to Robert Jones Realty for being a Gold Sponsor for Change-4-Change. We appreciate your support!

'Tis the season to give to Change-4-Change! Remember to bring in your spare change to make a difference and help provide Christmas for families in need.

We also have Business Sponsorships available. Swipe to check out the different levels. Use the QR code to donate online and email ladwigka@tfsd.org your logo.

https://sfnd.io/c4c2024

Congratulations to the TFHS Bowling Teams on their performance at the Varsity Baker Kickoff!

Girls took 1st place and Boys took 3rd.

Our community is so blessed to have amazing support from our local businesses, like CapEd. Thank you CapEd Credit Union for being a Gold Change-4-Change Sponsor.

Here is a look back at the successful second annual "No One Eats Alone" lunch at TFHS! 🎉 Organized as part of Reagan Horner's senior project, this event aimed to remind every student that they are not alone and foster a sense of community and support. 🤝

This year, we were proud to have several community partners come together to support mental health awareness, including:

The Jae Foundation 💙

BE Tree Foundation 🌳

988 Suicide Hotline 📞

Thrivent Financial Services 💼

A special thank you to Bill Ystueta from Chick-fil-A for generously donating 600 cookies to make the lunch even sweeter! 🍪

And of course, we couldn’t have done it without the incredible support of SOS Advisors Mariah Sorenson and Joni Peterson – thank you for your dedication and hard work to make this event a success! 🙏💖

#NoOneEatsAlone #MentalHealthAwareness #CommunitySupport #SOS #TFHS #StrongerTogether #BeTheChange #ThankYou

Thank you so much Jazzworks Dance Studio for your generous donation to Change-4-Change. We couldn't do it without sponsors like you.

Stall Day is Friday, December 6. At the start of each class period, you are invited to put change on your Teacher's Desk. Your teacher must count all of the change on their desk before they can start teaching that period! All of the change goes toward Change-4-Change and bringing Christmas to families in need.

🐄Congratulations to our TFHS FFA students for their outstanding performance at the Livestock Evaluation Career Development Event (CDE)! 🎉🐄

*Remington Barrow took 1st place individually! 🥇

*Gabriel Wilson-Stocks and Adan Alcaraz each placed in the Top 10! 🏅

And to top it all off, our FFA team placed 1st overall! 🏆👏

These students demonstrated exceptional knowledge and skill in evaluating livestock, showing what hard work and dedication can achieve. We're so proud of their accomplishments! 🚜🌱

#FFA #LivestockEvaluation #Teamwork #TFHS #AgricultureExcellence #FutureFarmers #HardWorkPaysOff #ProudMoment