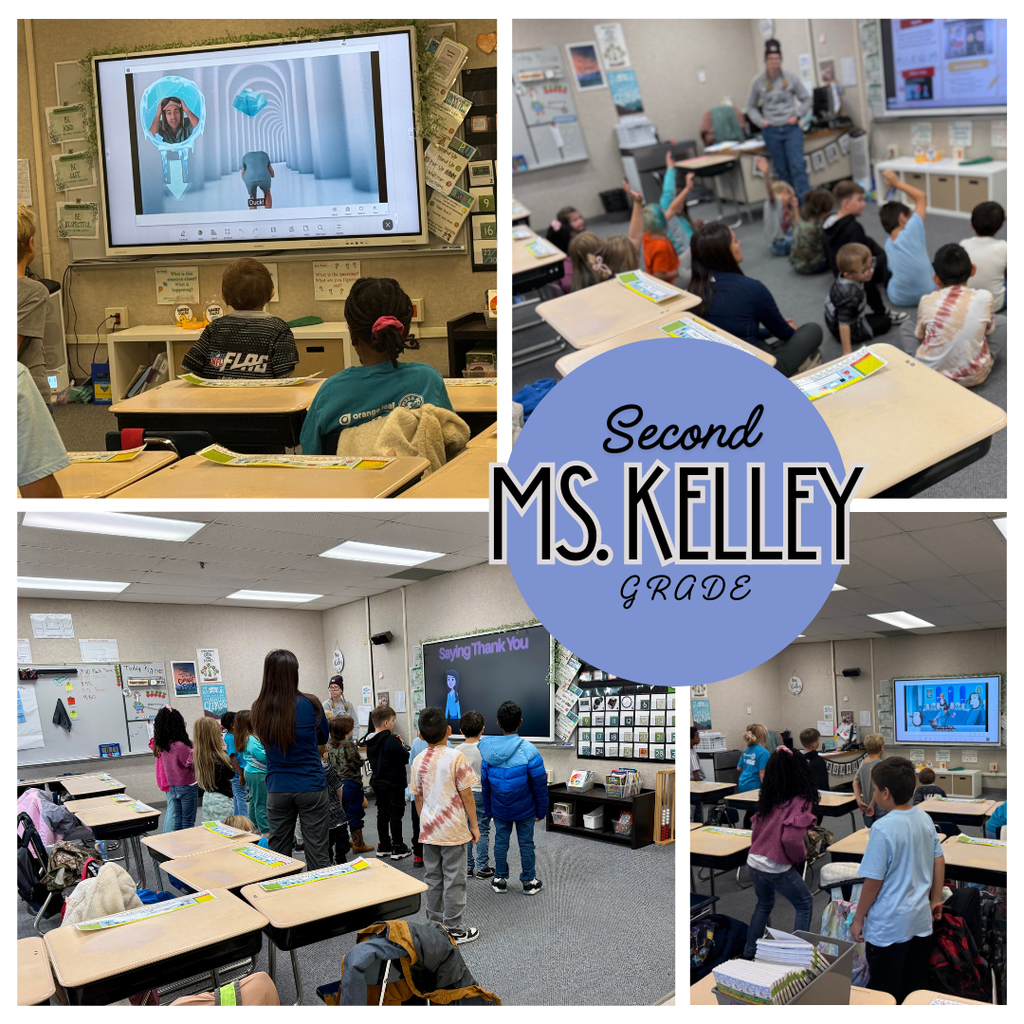

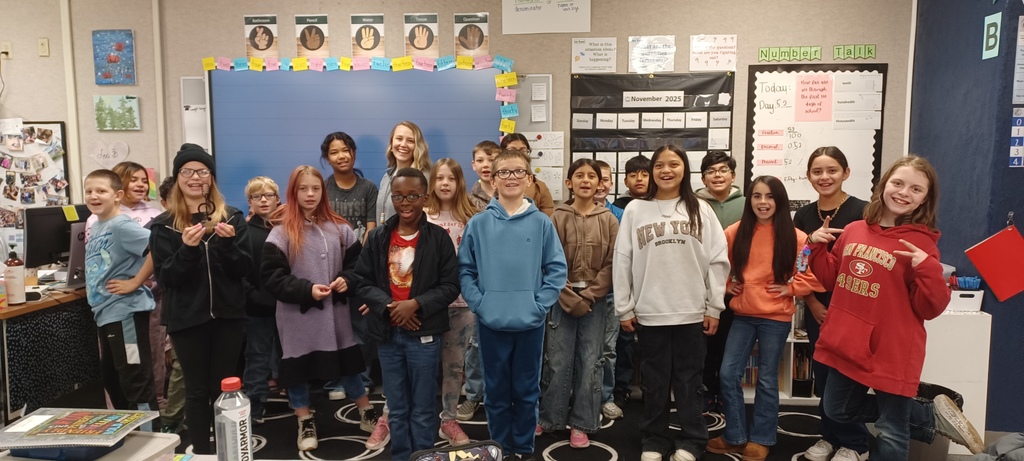

"Congrats, Ms. Kelley's class, with the ninth correct answer "A Sky Full of Stars" by Coldplay on this week's What's This Song?!? Wednesday Challenge!"

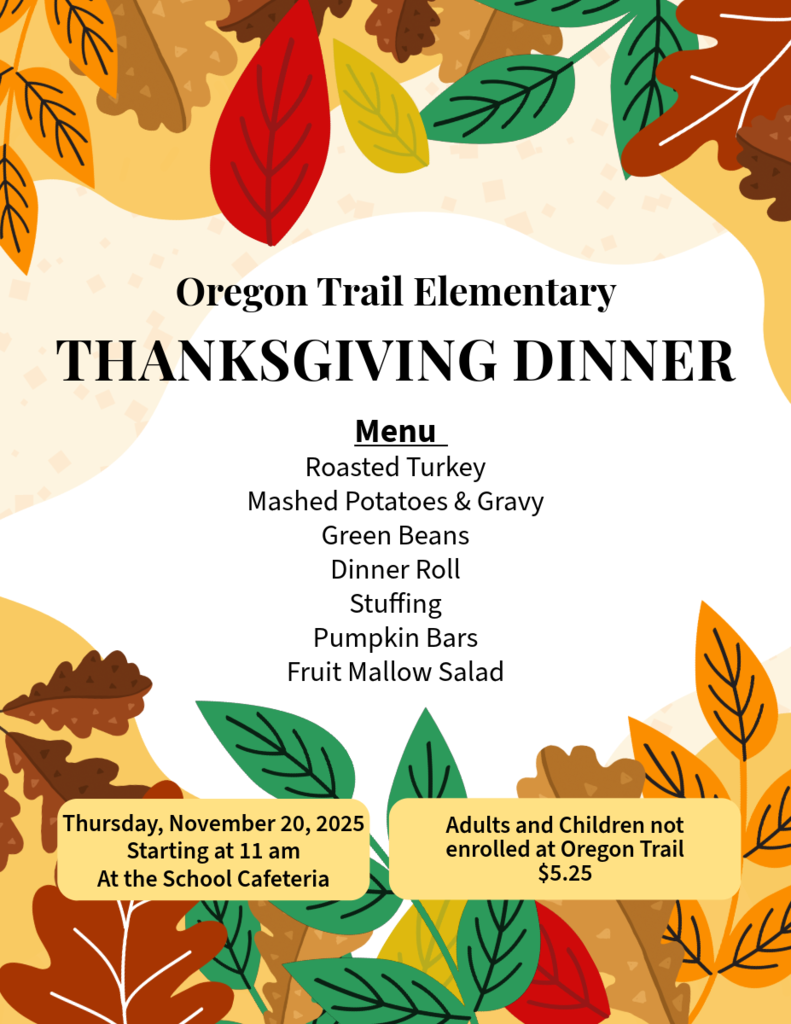

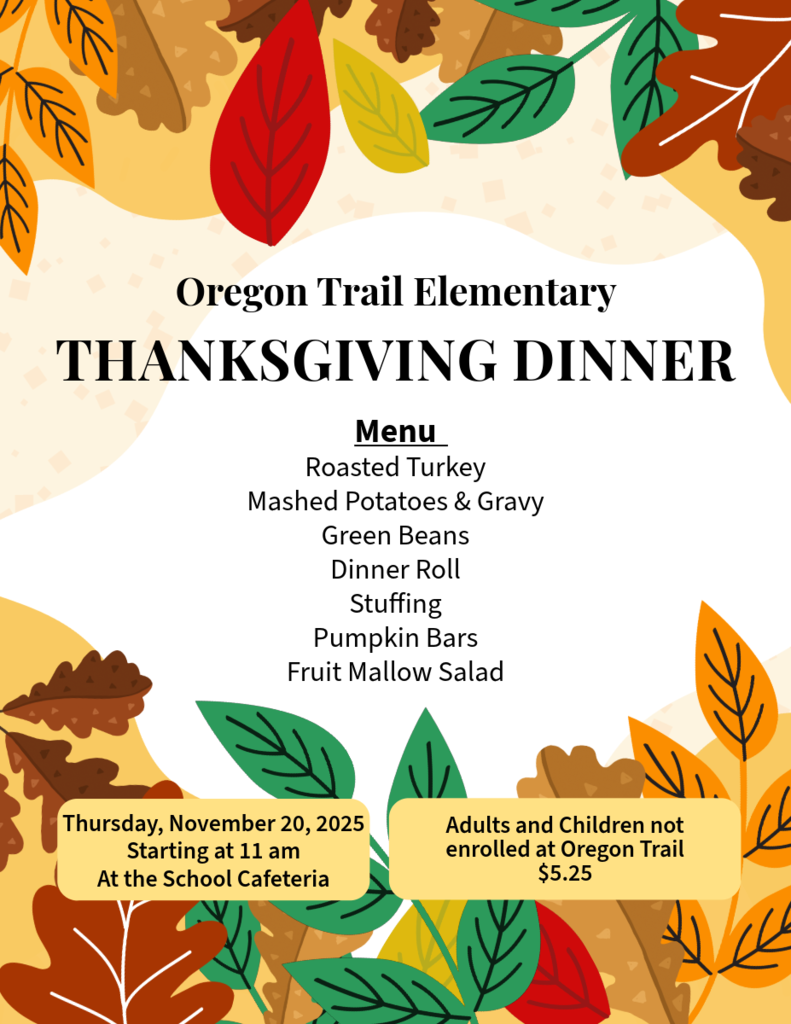

Don't forget about Thanksgiving Lunch Tomorrow!

Go get dinner and support our amazing school on Wednesday, December 3rd!

Check out week 13! Next week is our last week of school before we have a week off for Thanksgiving Break! Don't forget about our Thanksgiving Lunch on November 20th.

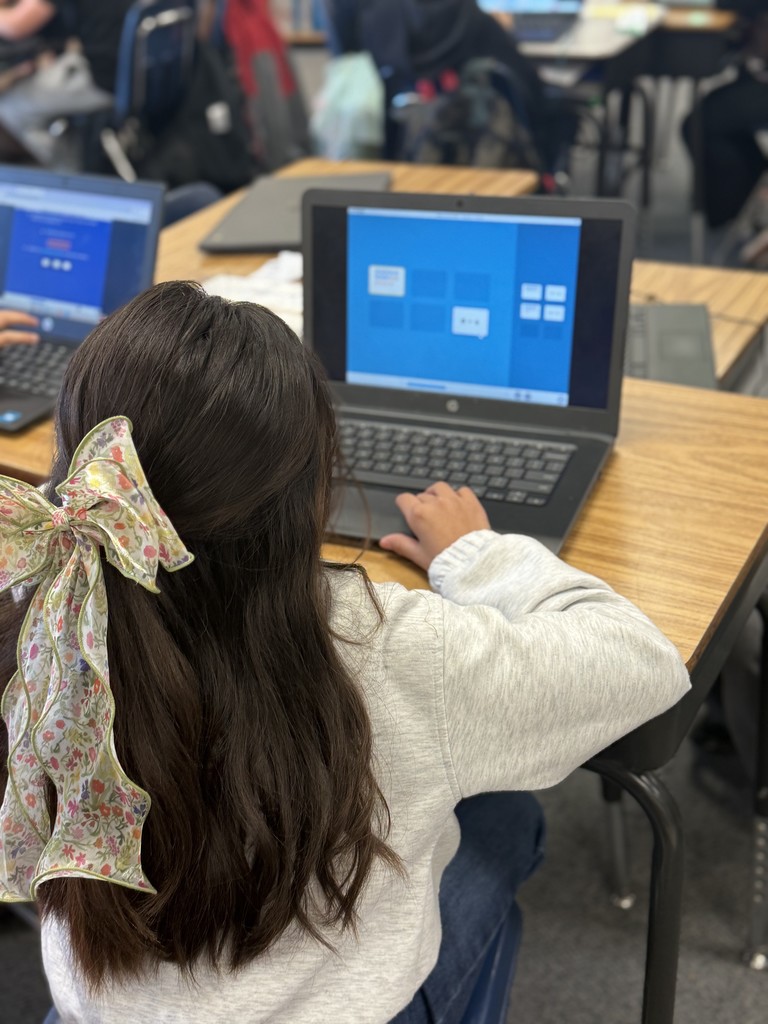

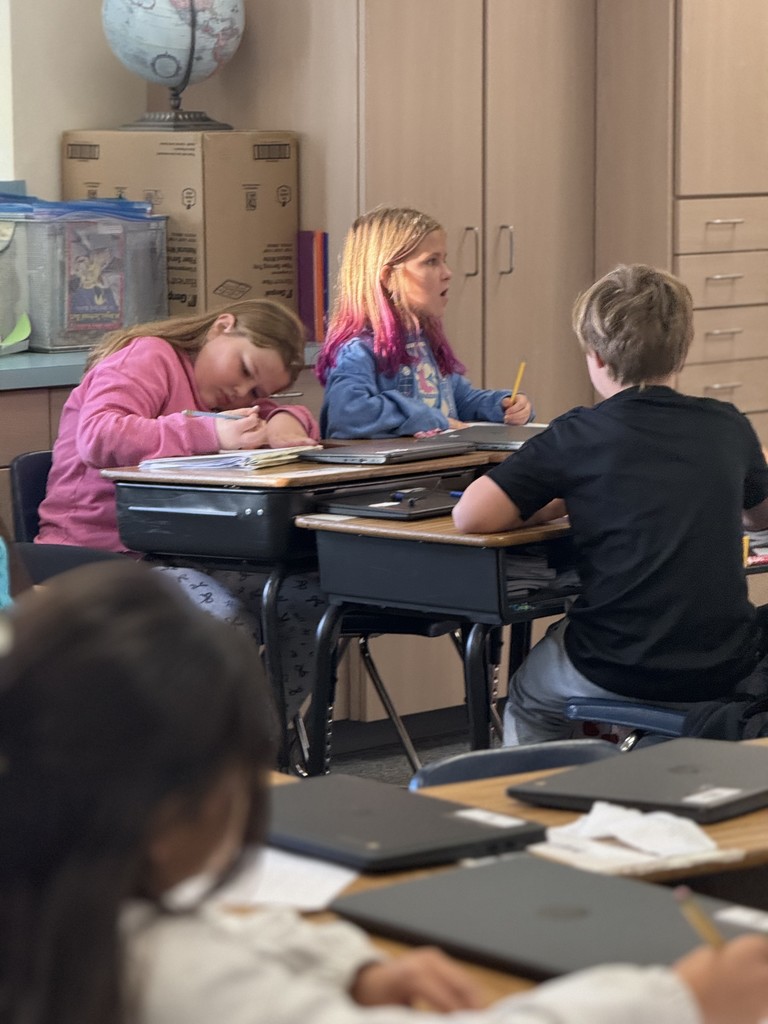

Ms. Bixler and her students had a very efficient start to their day. They started their day with the pledge and a song, which was followed by students joining in a big circle around the room to count by their multiples. Once students were finished, they were given a few minutes to get some iReady minutes in before practicing their spelling patterns through "Map It". Instead of starting their day with a Morning Meeting, they end their day with social and emotional lessons. Thanks Ms. Bixler for providing routines for students to be successful in the classroom. Photo Credit: Barsa, student photographer

Winners of the What's This Song?!? Wednesday Award for "Good Feeling" performed by Flo Rida

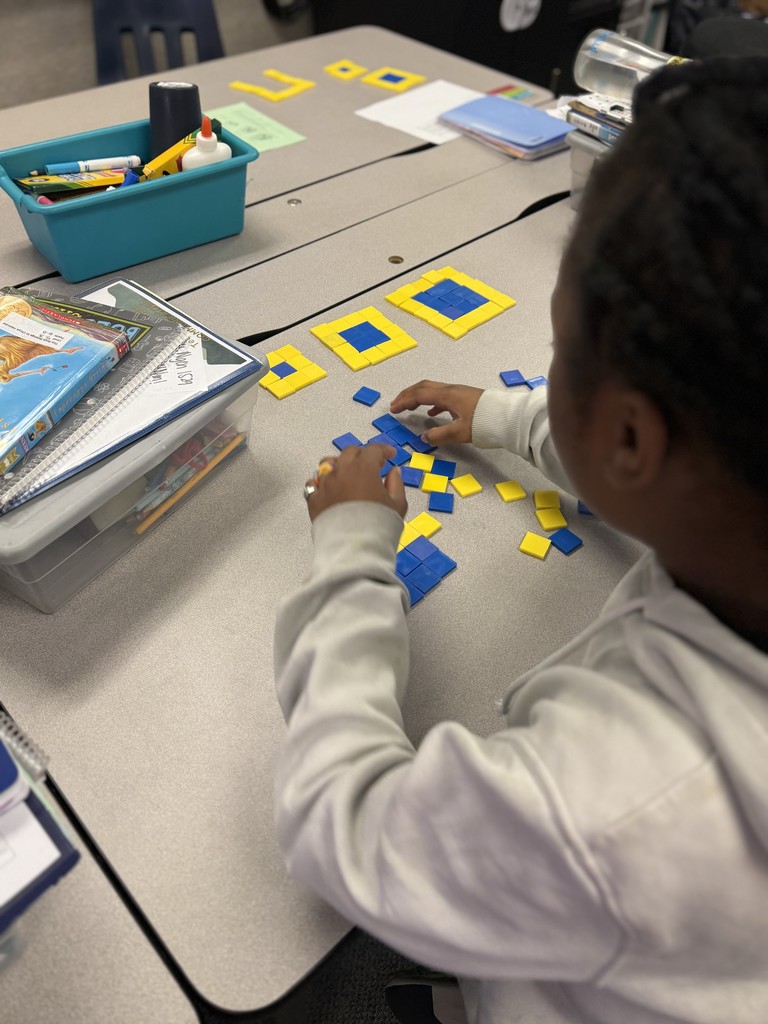

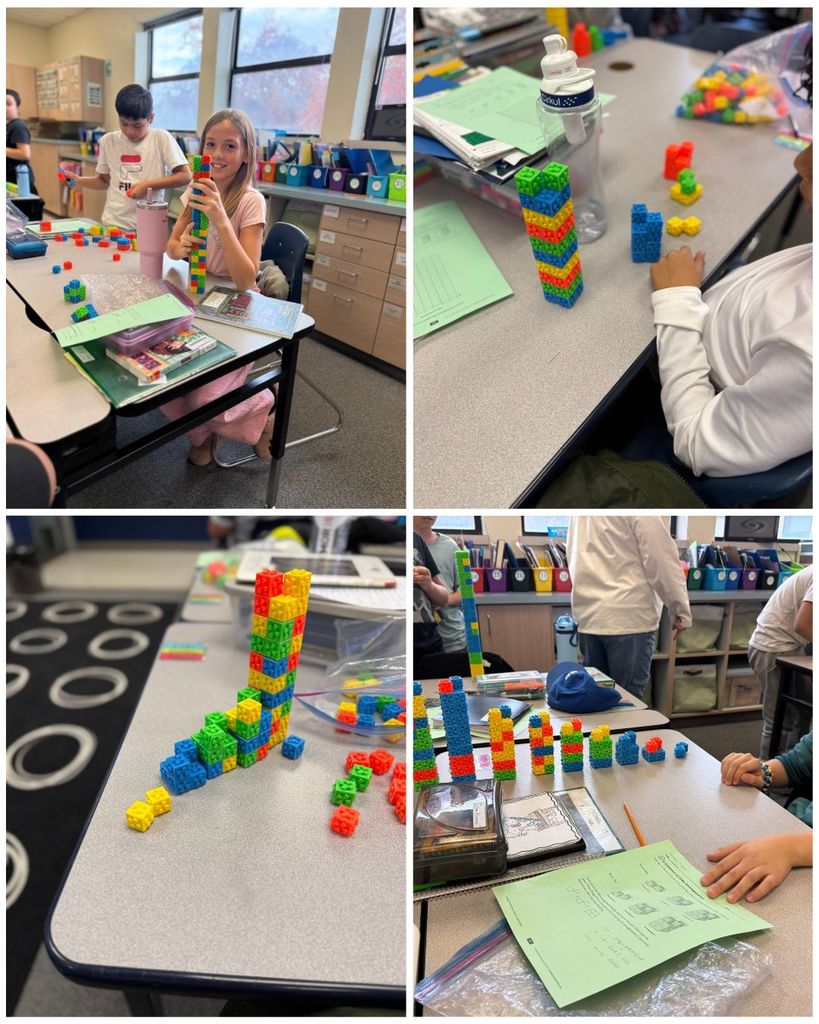

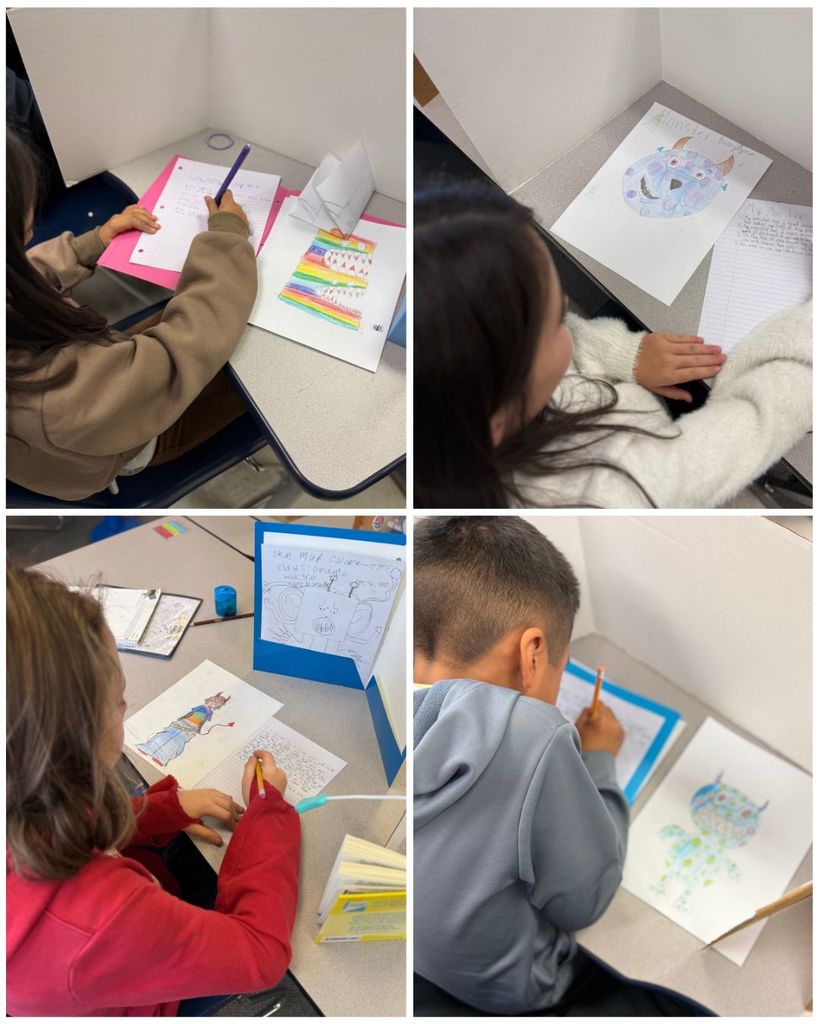

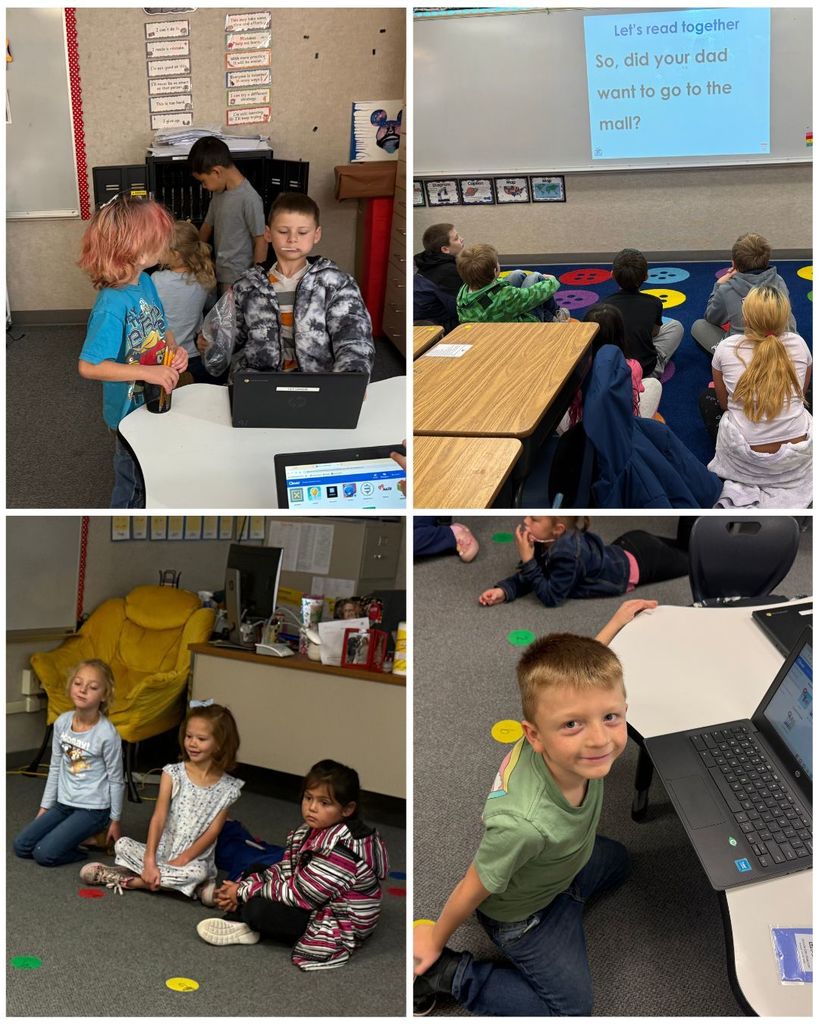

Week 12 was fun! Art, Finding Patterns, Descriptive Writing, Independent Work, Group Work, and so much more. Enjoy the rest of your weekend!

Lunch Times -

Kinder: 11:00

First Grade: 11:15

Second Grade: 11:30

Third Grade: 11:45

Fourth Grade: 11:55

Fifth Grade: 12:05

Kinder: 11:00

First Grade: 11:15

Second Grade: 11:30

Third Grade: 11:45

Fourth Grade: 11:55

Fifth Grade: 12:05

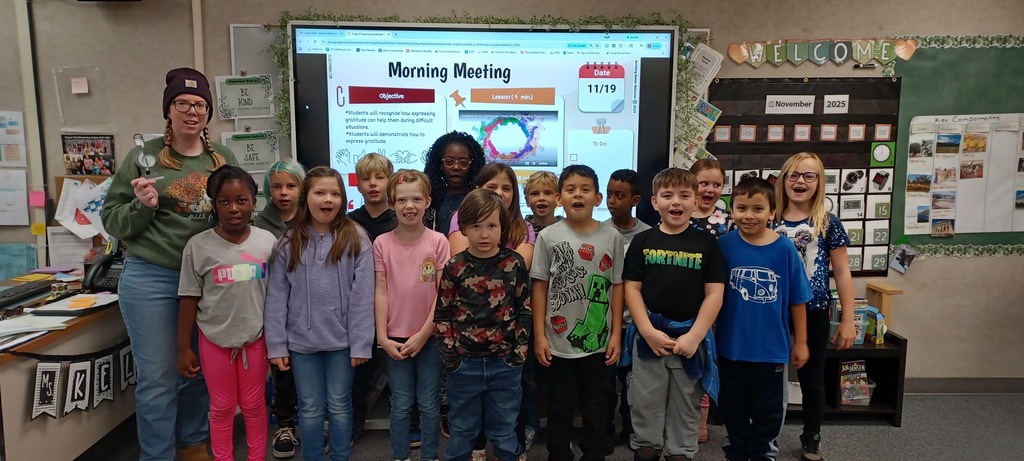

Ms. Kelley and her students started out with one of Mrs. Willsey's Morning Meeting Lessons focused on having good manners. They watched the video as a class and worked with partners when answering questions about treating others with respect. At the end of morning meeting, they were able to enjoy a fun brain break together as a class. Barsa was very impressed with how well behaved the class was. Thanks Ms. Kelley for starting your day by meeting the social and emotional needs of your students. Photo Credit: Barsa, student photographer

"Nice job Mrs. Boyle's class! 2nd week in a row with Walking on Sunshine."

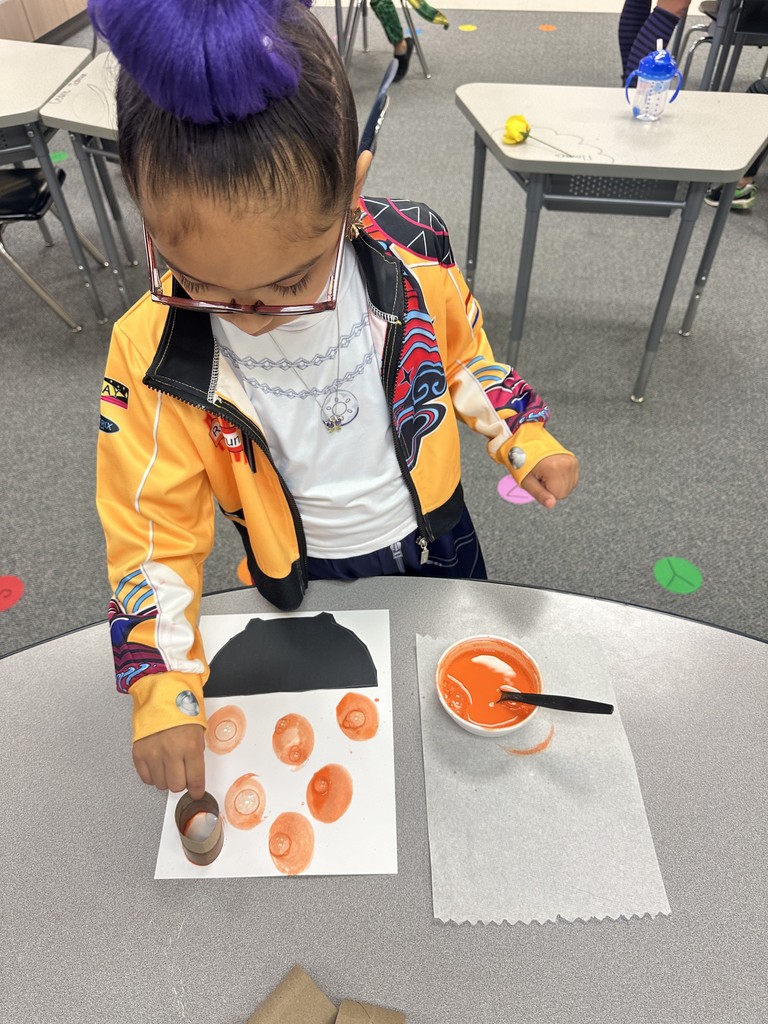

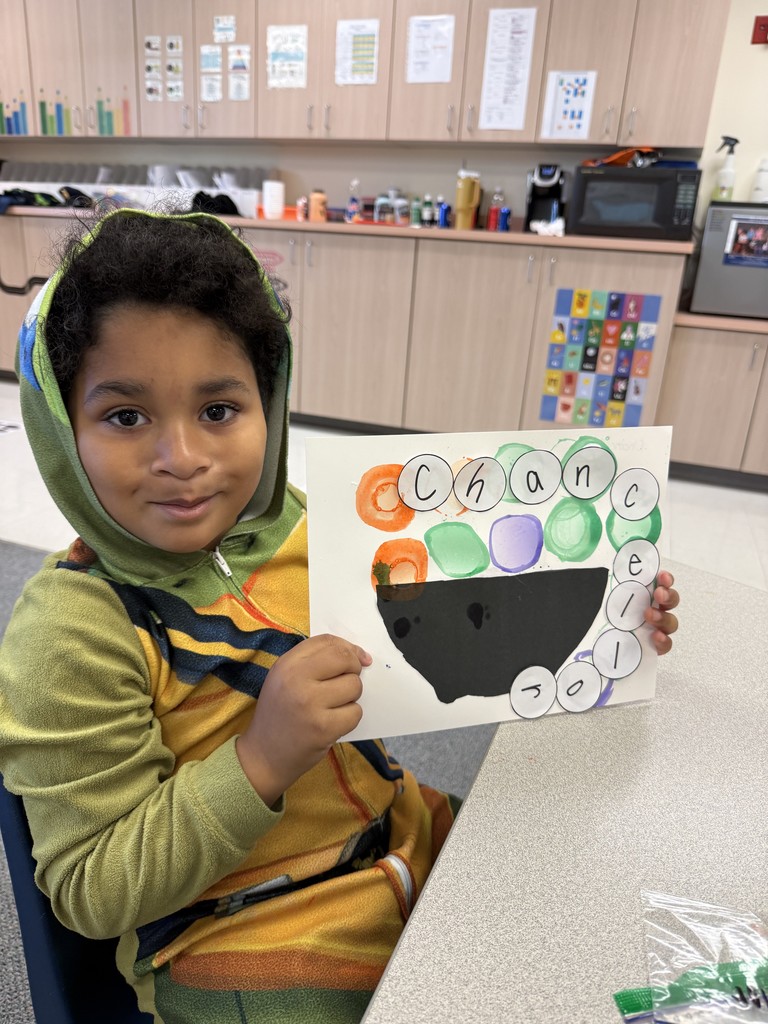

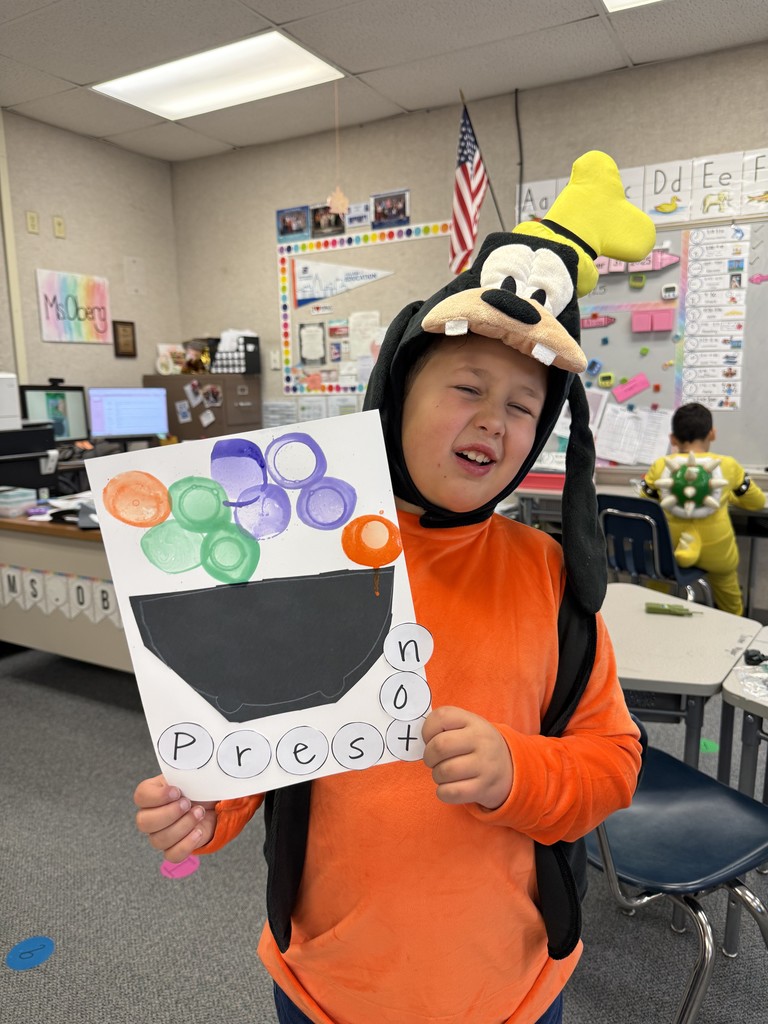

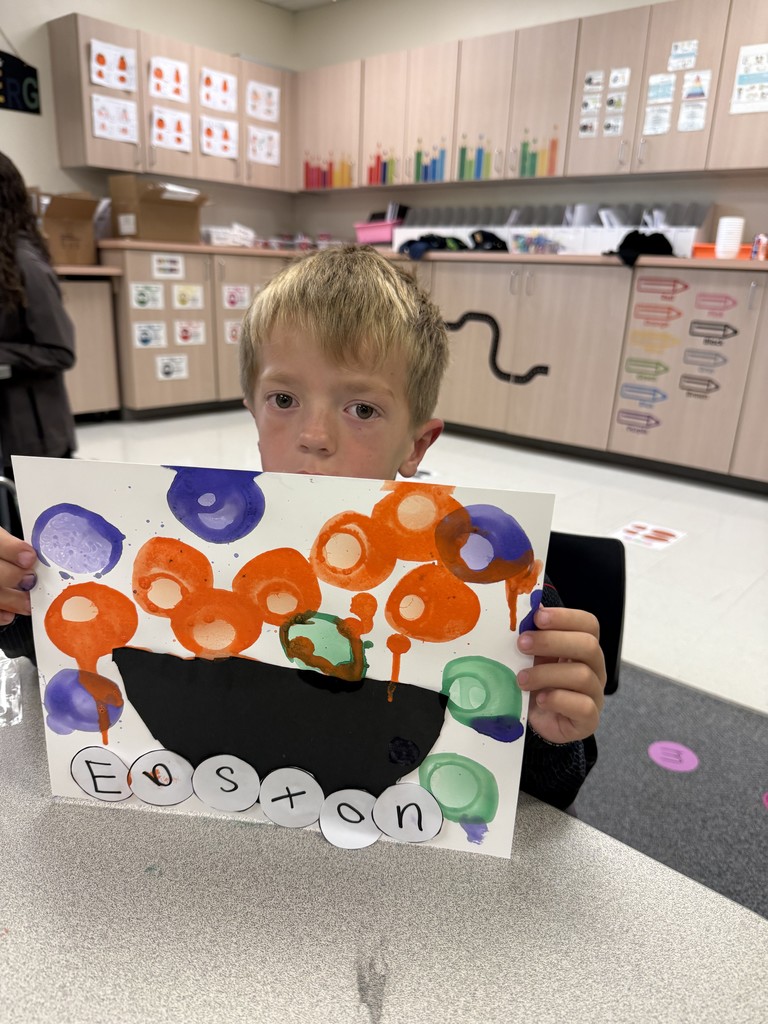

Last Friday was Halloween FUNctional Friday with Ms. Oberg, Mrs. Reichel, and Mr. Trevor! They created a bubble cauldron painting and worked on their fine motor skills by gluing the letters of their names onto their picture.

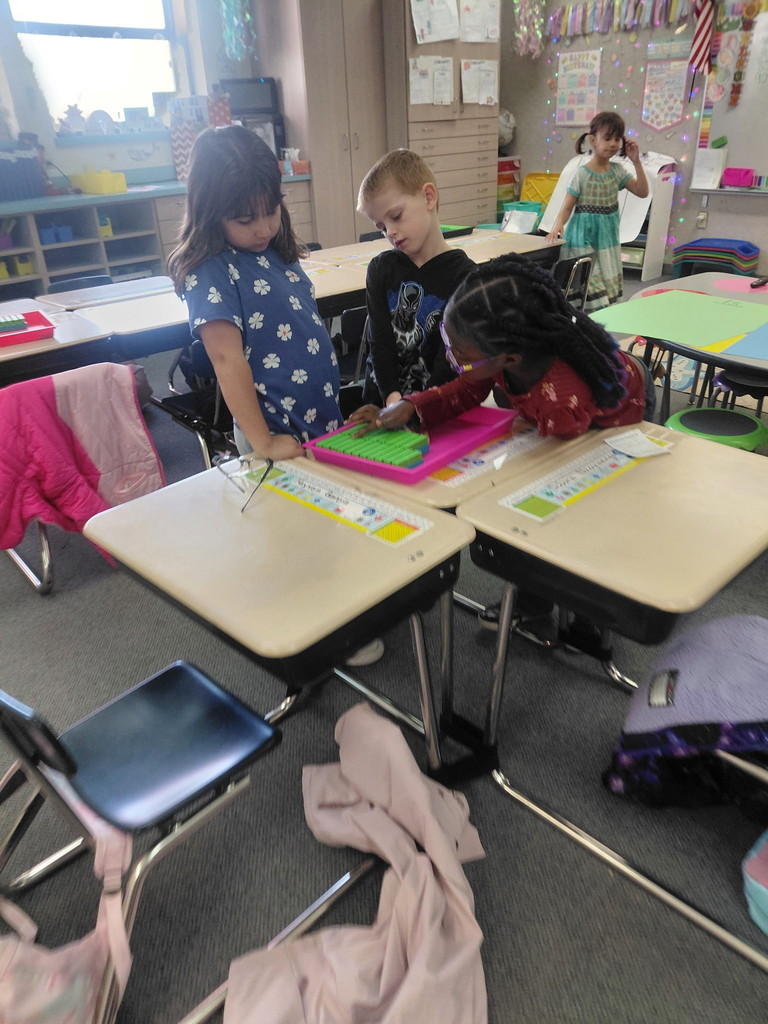

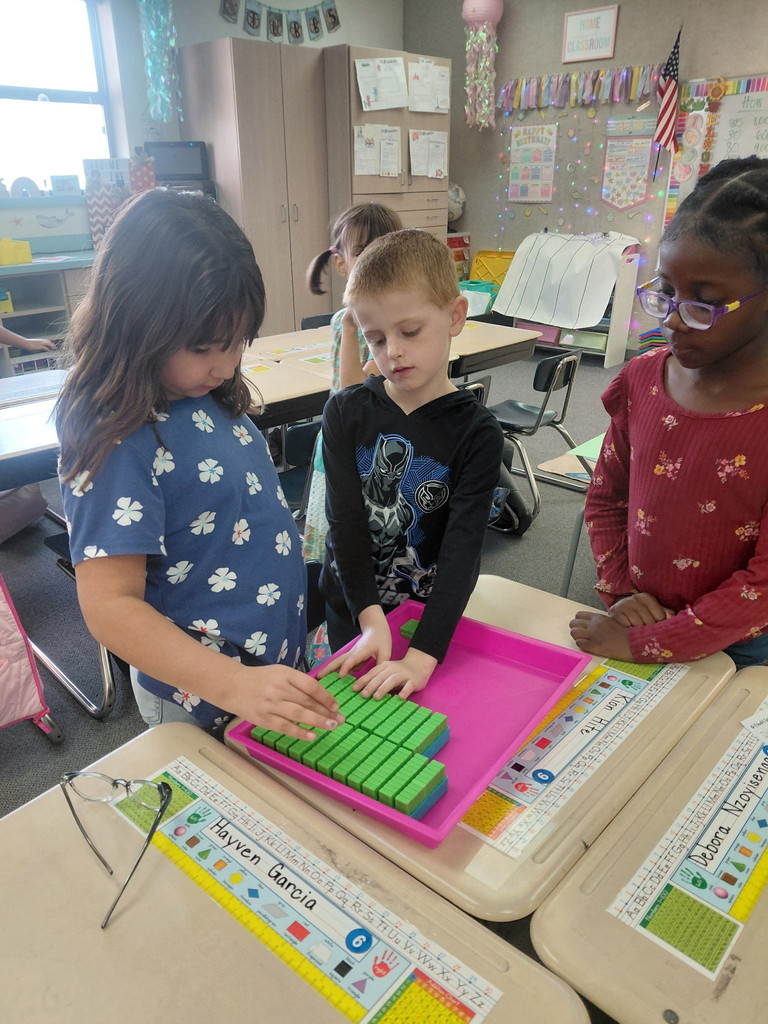

Mrs. Stephens and her students started the morning by talking about what makes a good friend. They watched Mrs. Willsey's morning meeting videos and participated in an activity called Mix-Pair-Share. It was evident that students knew the routines and knew how to respectfully have conversations with their peers. Our student photographer wrote all over the observation sheet, "smart", "good", "very good". She seemed to really enjoy being a part of their morning meeting. We love that Mrs. Stephens joined us at Oregon Trail this year. Photo Credit: Barsa, student photographer

We are embracing the chaos today! Halloween Parade and Parties coming up next. :)

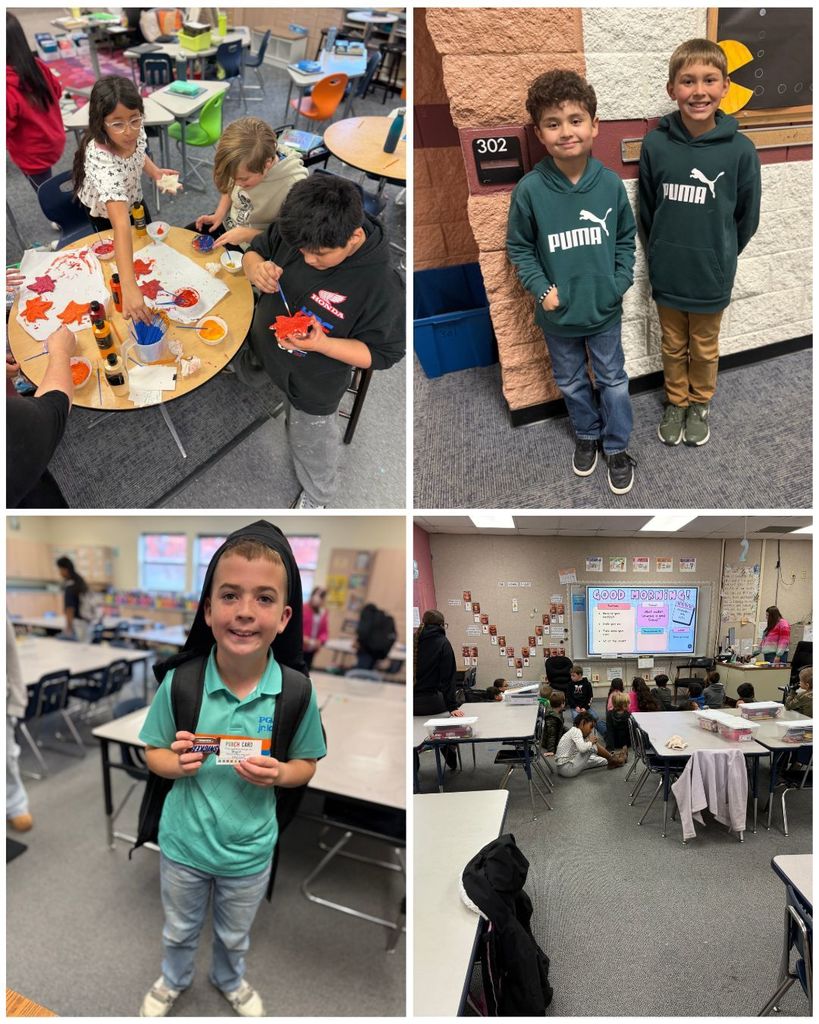

October Leaders of the Month with our students who have shown the most growth on their Dibels Test. Some students are not pictured. :)

We can't wait to see you tomorrow! :)

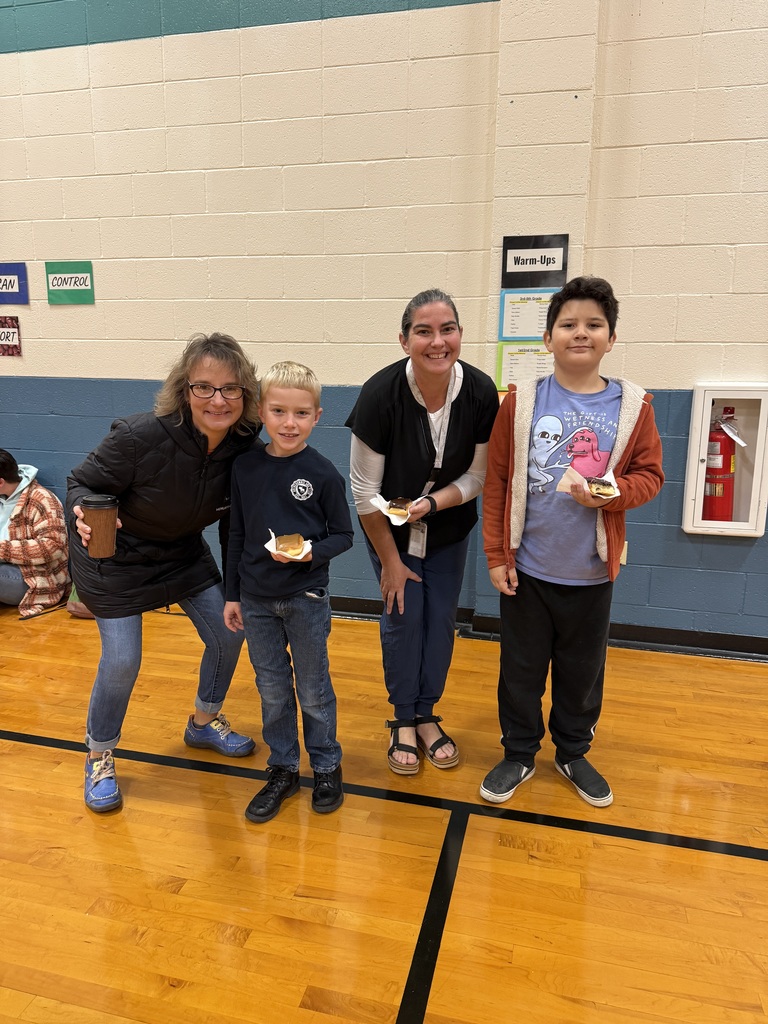

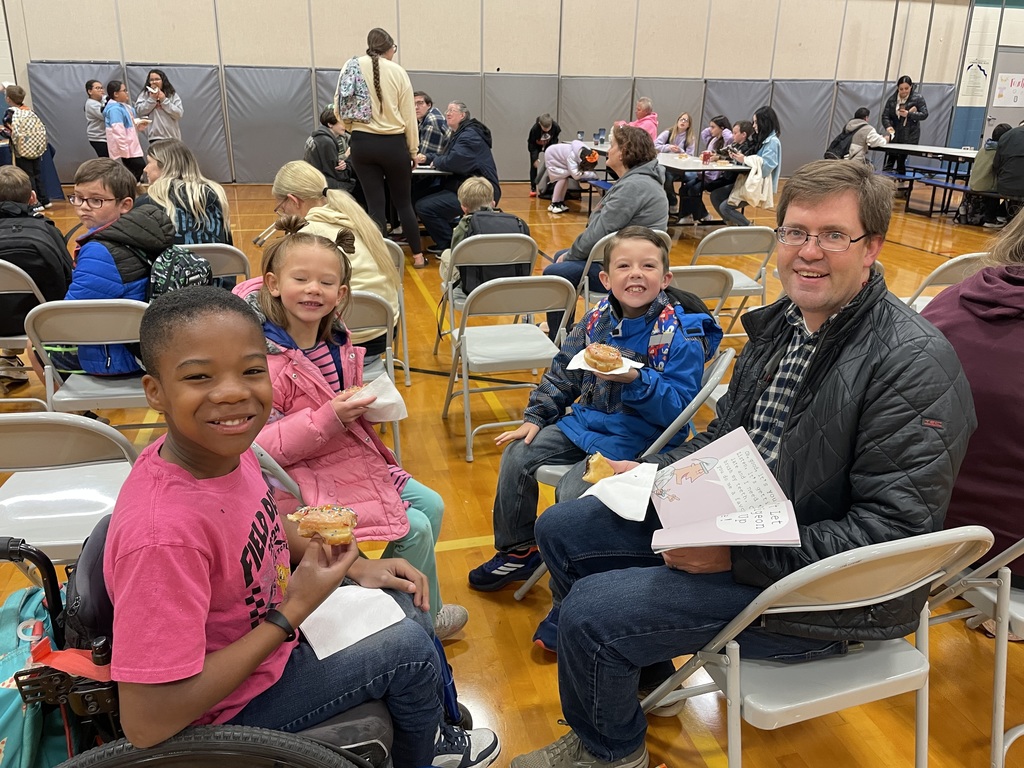

Week 10 was a big week! Breakfast Buddies, Parent-Teacher Connection Week, Book Fair, and so much more. I hope you are enjoying your long weekend. Next week, we have a family night, dress up days, and our Halloween Parade.

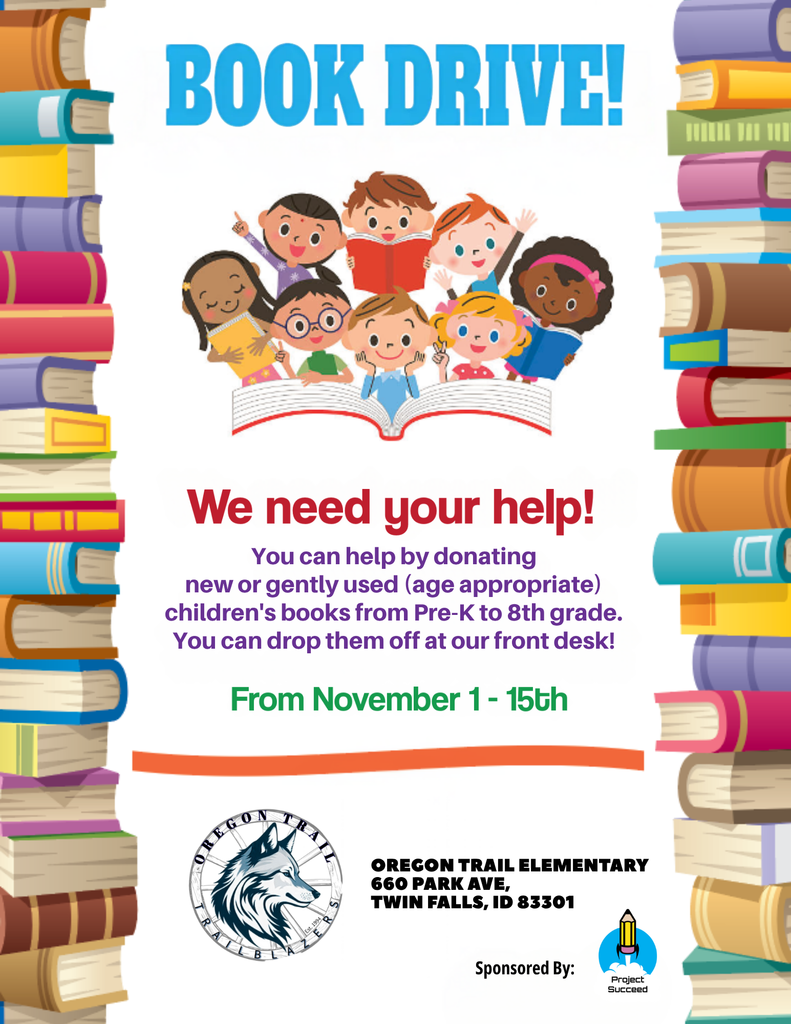

Book Drive!

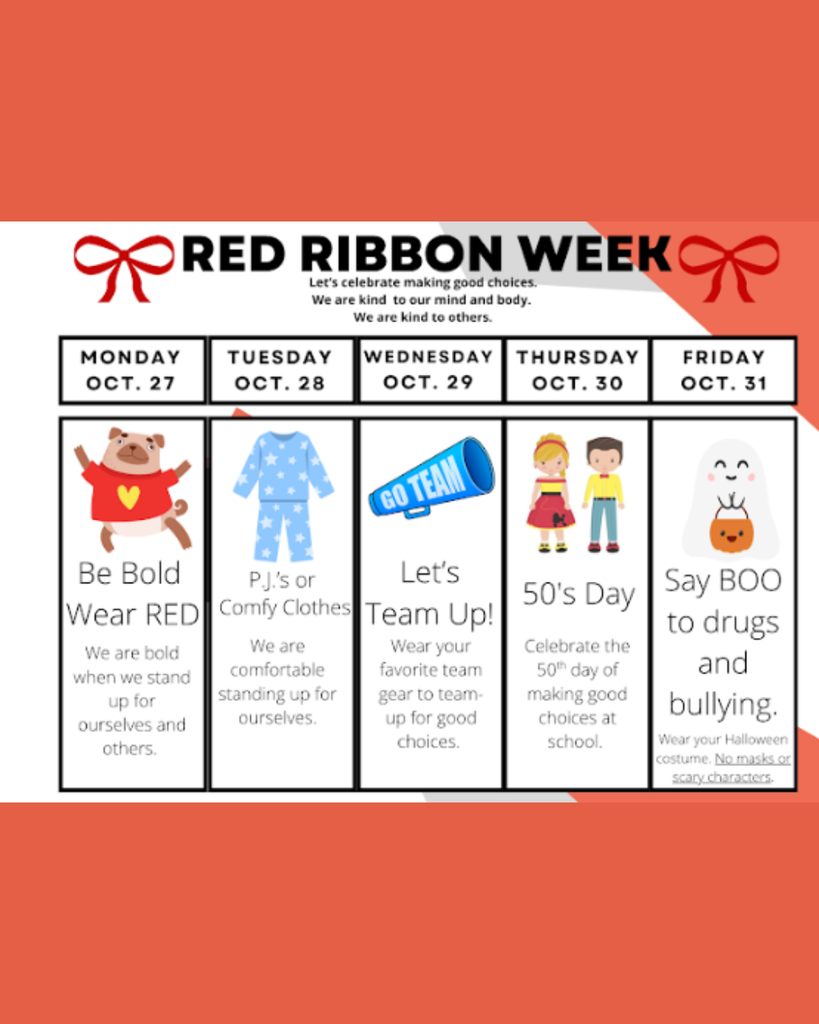

Every October we celebrate Red Ribbon week to raise awareness about violence and prevent alcohol, tobacco, and drug use. "Let's celebrate making good choices. We are kind to our mind and body. We are kind to others."

What's this song?!? Wednesday has been so fun! Mrs. Phillips, our music teacher is always spreading joy throughout our building. Each Wednesday a song is played over the intercom and classrooms all send their guess to which song they think is playing. The winning classroom receives an award that is showcased in their classroom for the week! Monster Mash was the winning song today.

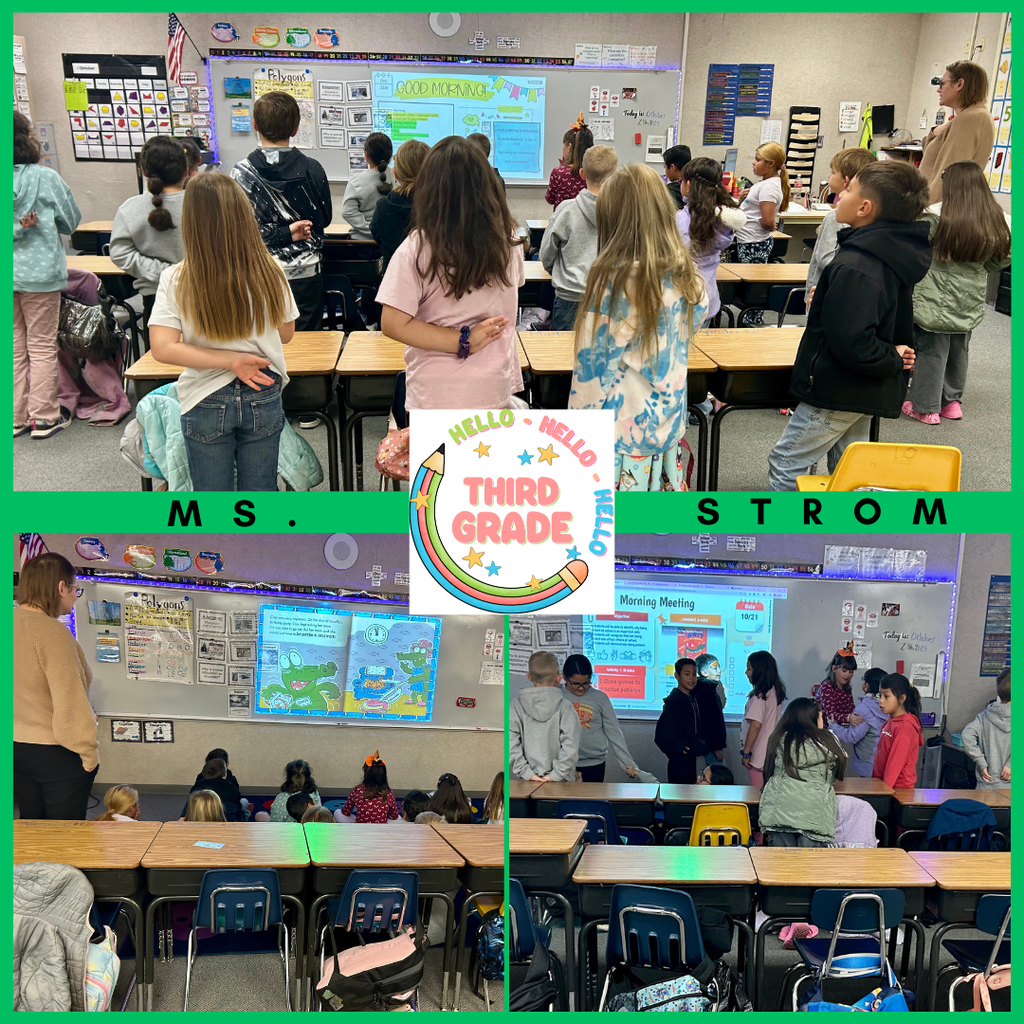

Yesterday morning was a great start in Ms. Strom's Class. They started out with the pledge before going to the carpet for morning meeting. They took time to read their objectives for the day before watching Mrs. Willsey's Morning Meeting video. The book that was read was "Croc Needs to Wait". This is a great book for learning about patience, as well as helping them learn the importance of waiting their turn. They were given the time to practice these skills through a Stand Up, Hand Up, Pair Up structure that they have learned in the classroom. Thank you Ms. Strom for prioritizing student engagement in your classroom and giving students the chance to share their ideas with their peers. Photo Credit: Student Photographer, Barsa